The Wyoming Legislature has introduced many measures to provide relief to residents following double-digit valuation increases after the COVID pandemic. These measures aim to assist both those struggling to pay their bills through targeted relief and broadly to all residents.

In Wyoming, property taxation is divided into three tiers, depending on the type of property:

Mineral Production: Taxed at 100% of productive value

Industrial Property: Taxed at 11.5%

All Other Property: Including commercial, agricultural, and residential properties, taxed at 9.3%

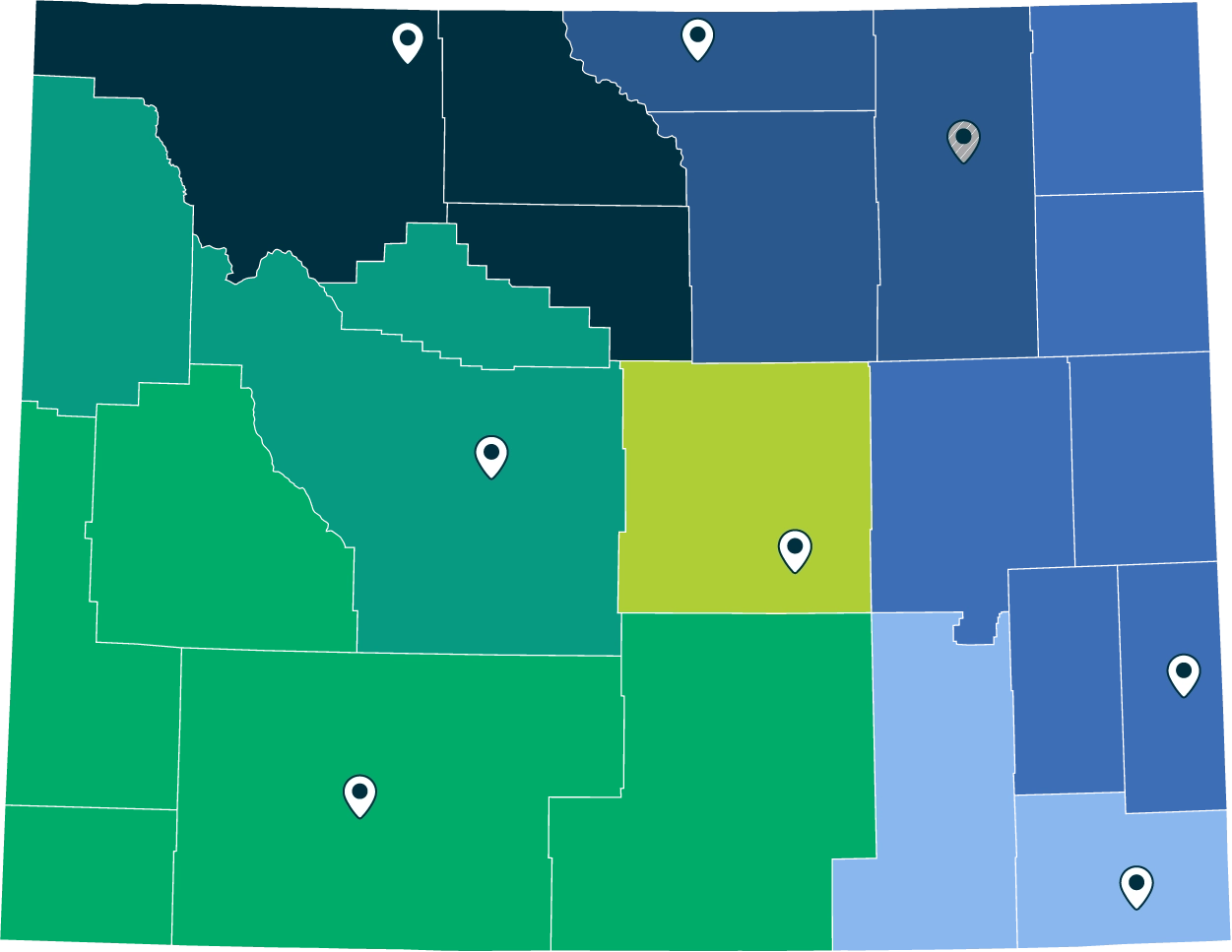

- Property taxes in Wyoming primarily fund local government services and schools. Community colleges receive around 4% of the property tax revenue in their county.

- The residential sector provides the most predictable and steady source of assessed value.

Wyoming residents have spoken through their vote to carve out the residential tier from the “all other” category, a measure that can further provide long-term property tax reform.

Property Tax Relief Resource Center

WACCT

Property Tax

FAQ

Wyoming Department of Revenue

Wyoming County Commissioners Association

Wyoming Taxpayers Association

The Tax Foundation

Learn More About Wyoming’s Community Colleges